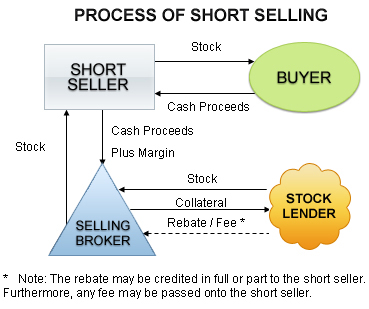

Carrying out a short stock selling request is not a big deal to equity brokers, they always have a way to go about it but shorting a stock regardless of is long duration or buying option is a different ball game with so many complicated issues. Before you short sell your stocks, you have to consider the following:

1. Sales risk

It is not advisable to short sell a stock because you stand the risk of making a huge loss unlike when you sell on a long term. When an equity is sold on a long term, the highest loss cannot exceed $150 when there is a borrowed margin to control investment. However, if any equity is borrowed on this margin and is short-sold; there will be a huge loss.

2. Locating the stock

Before you can short sell a stock, it has to be found and this process of finding stocks is professionally known as “locate.” If your equity broker is unable to find the stocks, then it is impossible to sell it. This problem arises due to unavailability of stock to borrow due to various reasons such as the stock not been held by many shareholders and/or that the stock has a large short position.

Suggested Readings: Some of the important Stock Market terms that you must know

3. Liquidity

It is inappropriate to short a stock without high liquidity. The absence of liquidity you can either work to your advantage or disadvantage. In a situation of short side selling, the liquidity rate of the stocks should be considered.

4. Rate of available short positions

You should find out the number of short stocks in the company, in the percentage of the stock float. If a company holds a large number of short stocks, the wise thing to do is to leave because it will reflect on the stock price.

5. Open a margin account

You need to open a margin account because that is where the money gotten from your borrowed stocks will be deposited. However, you should not expect any interest on this account because none will be given. Instead, you will be charged by your broker, to pay for the borrowed share rate according to the price of your equities when it was borrowed.

6. Make Margin calls

Peradventure your shorted stocks goes the wrong dimension; you will have to provide more money into your margin account which will be used for margin calls. In the absence of the money for margin calls, if there are other securities held in your margin account, your broker will have to sell them, in order for him to raise the money for the margin calls.

7. Timely sale

In a situation where you are not the original owner of the stocks and the owner decides to sell it, it is your duty to replace it immediately or locate other shareholders who are interested in buying it in the open market

8. Short squeeze

This is the process whereby the prices of stocks rise up quickly in the market, making it necessary for the stock to be bought in the open market so as to repay borrowed shares. A short squeeze brings about higher prices and sales.

9. Appropriate cover

You must ensure to give clear instruction to your equity broker on covering. Failure to do this can lead to the shooting of your stock. While communicating with your broker, clearly state that the purchase is meant to cover the open short position.

10. Dividend and taxes

In the situation of borrowing and shorting a dividend, you will definitely receive the dividends. However, you must endeavor to pay the owner of the stock in your possession, the value of the dividends.